Issues relating to exhibition goods for customs clearance and procedures

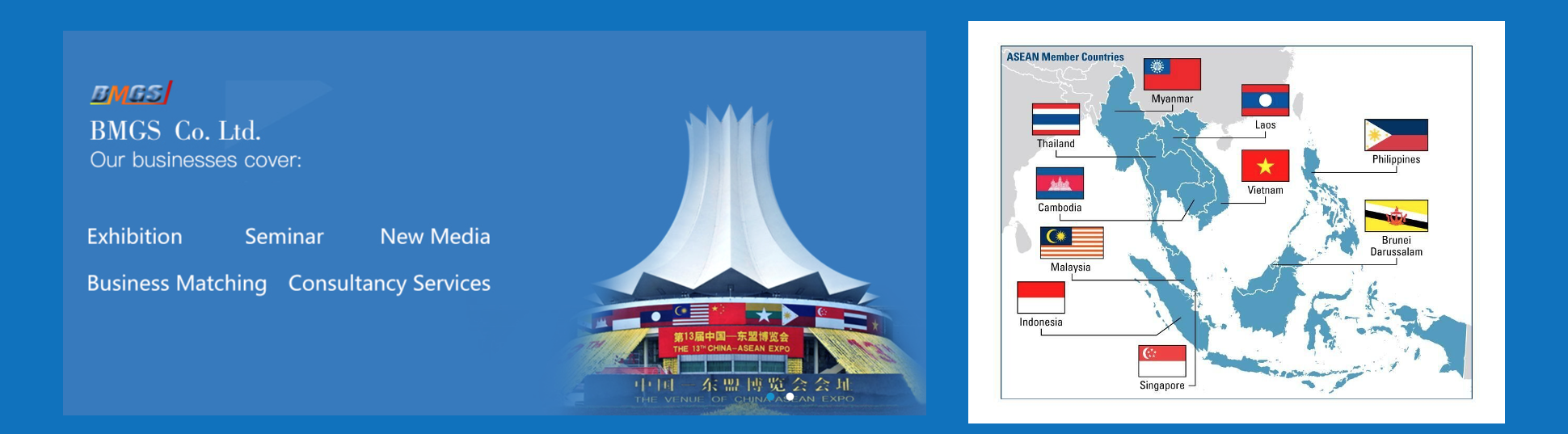

Most of the overseas’ goods will be shipped to the exhibitor’s origin country, therefore the exhibitor might face issues on export, import, re-export and re-import of goods. This is the difference between exhibition goods and other normal exported goods. Furthermore, the time taken for import and export of exhibition goods is much longer and the custom clearance will directly affect the participation of the exhibition.

Exhibition goods will usually be shipped back to exhibitor’s origin country in sealed condition after the exhibition in a foreign country. It is not only cumbersome but also unnecessary to follow the normal import and export procedure. Therefore, it is necessary to simplify and unify the customs procedure on the exhibition goods. Customs may grant approval for temporarily imported or exported goods. The procedures that the customs approve are the goods to be temporarily imported into and exported out of China’s customs territory, and re-transported out of or into the territory within the specified term. The temporary inbound and outbound goods shall be re-exported or re-imported in the original form except for the depreciation or wear and tear due to normal use.

Temporary inbound and outbound goods include goods displayed or used in exhibitions, fairs or similar activities can be processed according to the “Convention on Temporary Admission” signed in Istanbul in year 1990. This includes the following items:

Goods displayed or used in exhibitions; apparatus, equipment and articles used in exhibition; equipment, apparatus and articles used in the construction of projects; devices, equipment or articles used in news reporting, or the shooting of films or television programmes etc.

1. Customs clearance related issues

Overseas’ exhibitors often face the repeated issues on import, export, re-import and re-export of goods. This special procedure is of great importance to the exhibitors. For frequent import and export procedures , we should pay attention to the FAQ ( Frequently Asked Questions)

Exhibitors, freight forwarders, logistics, customs, commodity inspection, insurance, bank, warehousing and many other institutions played a big part in the import and export process especially freight forwarders. Those experienced freight forwarder with good credibility, good management and technology are well-received by the exhibitors. Freight forwarders have their own vehicles, however ,currently , the logistics are managed by the professional transportation team, while the agent is in-charged of the warehousing, domestic transportation, handling, customs clearance, reservation etc.

Goods displayed or used in exhibitions belong to temporary inbound and outbound goods where they will be exempted from import and export license, import duties and other duties etc. Even during the exhibitions, the goods are under the surveillance of customs, without customs’ permission, the exhibition goods cannot be removed.

The exhibition goods that are temporarily imported or exported upon the date of entry are required to re-transported out of or into the territory within the specified term. Under British regulations, goods approved for temporary imports need to be exported within two years with no extension, Japan for one year, United Sates of America for one year with one year extension and two opportunities for extension, Germany for three months with three months extension. Since the exhibition will be held at such given time, therefore the efficiency of customs handling is rather important. However, the customs handling procedure such as customs documentation, customs clearance are differed from one country to another.

2. Exhibition goods import and export procedure

Exhibition goods import and export procedure include the following procedures:

a) Exhibitor will send the list of exhibition goods to the freight forwarders

b) The trustee will duplicate the list of exhibition goods for customs preparation, shipping and cargo reservation

c) Prepare transport document, 3 copies of the export exhibit goods declaration form

d) Customs

e) Inspection and insurance

f) Shipment

g) Shipment notification

h) Issued bill of landing and pass to the freight forwarders

i) Freight forwarders hold the bill of lading

j) Exhibitors or the freight forwarders will notify the local agents of the organizer of the exhibition

k) Import procedure of exhibition goods at the local exhibition (the local agent or the organizer will provide the information of the exhibition goods to the customs in advance to facilitate further arrangement; exhibition goods will go to customs inspection department for declaration once they arrive ; the local agent or the organizer will follow-up with the declaration procedure; the exhibitor and the local agent will provide a guarantee to the customs; submit the list of exhibition goods; payment of customs’ duties other than duty free exhibit goods (customs inspection, delivery according to bill of landing); Any imported goods sold during an exhibition and are not paid their due duties, the duty payer shall be the original importer.

The organizer or exhibitor who import the item, sample or information obtained during an exhibition should do the separate packing and listing down of the items as requested by the customs’ rules and regulations. With regards to the purchased items, other than the cutlery used by the staffs, they have to be checked and approved by the authorities . When exhibition goods are imported without paying any duty and are sold during an exhibition, the duty payer shall be the original importer.